Unlocking Opportunities in the Latin American Market for Global Asset Managers

KICKOFF 2024

Strategic Insights from the Kick-Off 2024 Survey

The Kick-Off 2024 event, organized by Latam Consultus, served as a pivotal gathering for independent financial advisors from across Latin America, including Uruguay, Argentina, Chile, and Brazil.

Lynk Markets conducted a survey during this event on March 6-7, 2024. Out of more than 300 attendees, 73 engaged financial advisors chose to participate by scanning a QR code that led them to the survey site. This report delves into the survey responses, providing valuable insights to market players keen on penetrating the Latin American market and connecting with investors through their advisors within broker/dealers, multi-family offices, and private banks.

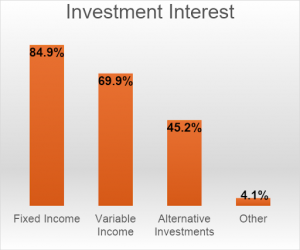

Investment Interests: A Diverse Appetite

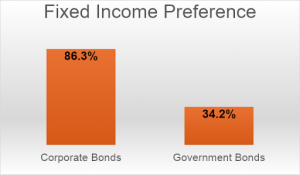

Fixed Income Dominance: With 84.9% of advisors showing interest in fixed income, there’s a clear demand for stable, predictable investments. For global asset managers, this underscores the importance of offering robust fixed income products, especially corporate bonds which saw an 86.3% preference.

Fixed Income Interest: Corporate Bonds Lead

The overwhelming preference for corporate bonds over government bonds among respondents (86.3% vs. 34.2%) signals a market leaning towards higher yields despite potential risks. Asset managers with a diverse corporate bond portfolio can leverage this insight by highlighting the performance and risk management strategies of their offerings.

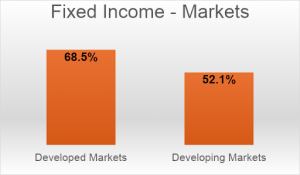

Market Interest: Developed vs. Developing

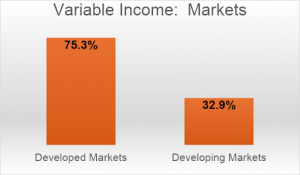

While there’s a notable interest in both developed (68.5% for fixed income) and developing markets (52.1% for fixed income), the skew towards developed markets in variable income investments (75.3%) suggests a nuanced investment approach. Asset managers can cater to this by balancing offerings across both market types, potentially integrating emerging market strategies with the stability of developed markets.

Variable Income and Equity Markets: Interest in variable income (69.9%) and a pronounced preference for developed markets (75.3% for variable income) highlight a dual strategy: seeking growth while managing risk.

A notable preference among Latin American financial advisors for variable income strategies in developed markets, with 75.3% expressing interest. This inclination towards developed markets stems from their perceived stability, regulatory transparency, and the depth of their financial instruments. By focusing on these markets, advisors aim to mitigate geopolitical and currency risks associated with emerging markets, while seeking consistent growth and diversification for their clients’ portfolios.

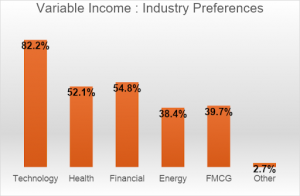

Industry Preferences: Technology, Financial and Health Sectors Stand Out

The preference for investing in technology (82.2%), healthcare (52.1%) and financial sectors (54.8%) within variable income highlights sectors that Latin American advisors believe will drive future growth. This indicates an opportunity for asset managers to focus on sector-specific funds or products, especially in these rapidly evolving industries.

Alternative Investments: The 45.2% interest in alternative investments, with a leaning towards private equity (42.5%) and real estate (37%), signals an evolving market open to diversification.

Global managers specializing in these areas have a significant opportunity to introduce sophisticated products tailored to these preferences.

Alternative Investments: Diversification Beyond Traditional Assets

The interest in private equity and real estate underscores a search for assets that offer growth, income, and diversification. Asset managers offering unique alternative investment opportunities can find a receptive audience among Latin American advisors looking to differentiate their portfolios.

With 45.2% of surveyed independent financial advisors from Uruguay, Argentina, Chile, and Brazil expressing interest in alternative investments, we are witnessing an enthusiasm at levels unprecedented in the region. This surge is not merely a quantitative shift but signifies a qualitative transformation in how Latin American advisors and their clients perceive investment diversity and risk management. For global portfolio (asset) managers, these insights are invaluable for tailoring investment strategies to the evolving needs of the Latin American market.

Unpacking Preferences in Alternative Investments

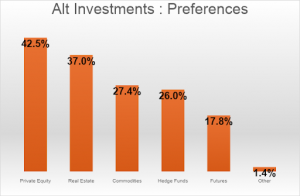

The survey delineates a clear preference hierarchy within alternative investments:

Private Equity: Leading with 42.5% interest, private equity is seen as a vehicle for tapping into high-growth potential companies, often inaccessible through public markets. This preference indicates a sophisticated investor base, keen on leveraging direct investments for superior returns.

Real Estate: Garnering 37% interest, real estate investments are perceived as a tangible asset class offering stable income and potential capital appreciation, alongside inflation protection.

Commodities: With 27.4% interest, commodities are recognized for their diversification benefits and hedge against inflation, resonating with advisors looking to mitigate portfolio risk.

Hedge Funds and Futures: Though hedge funds (26%) and futures (17.8%) show lower preference levels, their inclusion reflects a nuanced approach to achieving portfolio diversification, leveraging strategies like short selling and derivatives for risk-adjusted returns.

Broad Spectrum of Investors:

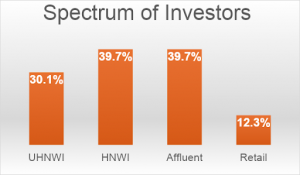

Financial advisors in Latin America represent a broad spectrum of investors, including ultra-high-net-worth individuals (UHNWI) with assets exceeding $10 million (30%), high-net-worth individuals (HNWI) with assets between $2 million and $10 million (39.7%), affluent individuals with assets ranging from $500K to $1.99 million (39.7%), and the retail segment with assets under $500K (12.3%). This diversity not only underscores the market’s sophistication but also highlights the imperative for asset managers to tailor their strategies. Providing data-driven insights, customized investment solutions, and exceptional customer experiences is crucial.

Strategic Implications for Global Asset Managers

The interest in alternative investments among Latin American advisors requires a strategic recalibration for global asset managers. The preferences articulated through the survey, with advisors seeking to balance growth, risk, and diversification, offer a roadmap for developing and marketing investment products tailored to the Latin American market:

Emphasize Direct Investment Opportunities: Given the strong interest in private equity, asset managers should consider offering products that provide direct exposure to private markets, including venture capital, growth equity, and buyouts. Tailoring these offerings to sectors with high growth potential can align with advisors’ aspirations for outsized returns.

Diversify with Real Assets: The notable interest in real estate investments points towards an appetite for real assets. Global managers could expand their product suite to include REITs, direct property investments, and real estate debt instruments, catering to the demand for tangible, income-generating assets.

Tailored Product Offerings: Develop and market products that align with the specific interests and risk appetites highlighted in the survey, such as corporate bonds in technology and health sectors, and alternative investments like private equity and real estate.

Educational Outreach: Recognizing that alternative investments can be complex and diverse, asset managers should also invest in educational initiatives. Workshops, webinars, and advisory materials that demystify alternative investments and highlight their strategic role in portfolio construction can empower advisors to make informed decisions.

Partnership and Collaboration: Collaborating with local financial advisors within financial institutions, such as broker/dealers, multi-family offices, and private banks, can facilitate the introduction of alternative investment products. These partnerships can serve as conduits for both distributing products and gaining deeper insights into local market dynamics and investor preferences.

Conclusions

The insights gleaned from Lynk Markets’ survey unveil a dynamic and sophisticated Latin American financial advisory landscape, full of opportunities for global portfolio managers.

By aligning product offerings and strategies with the preferences and needs of Latin American advisors, asset managers can unlock significant business opportunities. This alignment facilitates growth and diversification in portfolios across the region, enabling effective engagement with this vibrant market. Moreover, it fosters long-term relationships and drives mutual growth, illustrating a promising horizon for international asset management firms looking to expand their footprint in Latin America.

During the Kick-Off 2024 event held on March 6-7, organized by Latam Consultus, Lynk Markets conducted a targeted survey to glean insights from the financial advisory sector in Latin America. This survey was a key feature at Lynk Markets’ stand, where over 300 attendees had the opportunity to engage with various exhibits and offerings. As part of their interaction at the stand, 73 attendees were invited to complete the survey, a process facilitated through a QR code scan that redirected them to the survey site. This digital method of participation ensured that the responses were captured and saved electronically, providing Lynk Markets with immediate and accurate data from a significant portion of the event’s attendees. In recognition of the participants’ time and contributions, they were offered a giveaway, enhancing the overall experience and participation rate. This survey initiative by Lynk Markets on March 6-7, 2024, not only underscored the company’s commitment to understanding the dynamics of the financial advisory landscape in Latin America but also highlighted the effectiveness of integrating technology and incentives to gather meaningful industry insights.

Disclaimer: The content of this blog post is for informational purposes only and is not intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information provided does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the content as such. LYNK Markets does not recommend that any securities should be bought, sold, or held by you. Do your own due diligence and consult your financial advisor before making any investment decisions.