One stop solution for portfolio strategies & alternative investments

Connecting Markets,

Creating Opportunities

Uniting buyers and sellers, we fuel growth through technology-driven solutions and an exceptional customer experience.

Contact Us

Financial Advisors

Broker/Dealers, Family Offices

& Private Banks

Asset Managers

Advanced Securitization and

Other Services

Create a bankable security to enhance access to your investment strategy to qualified investors.

LYNK MARKETS SMA solution securitizes investment strategies held in a custody/trading account through the issuance of Euroclearable securities with an ISIN. It provides a cost efficient solution for all size portfolios and allows distribution to non-retail investors worldwide. Our one stop solution handles the issuance, maintenance, track record and real-time product information, thereby allowing Portfolio Managers to create unique investment products from their individual strategies.

Create your own products with a turnkey solution

Develop investment strategies that the market demands with the constant support of recognized global financial and legal institutionsAllow efficiencies for cost and time-to-market

Take advantage of the LYNK´s platform that allows for the quickest time to market at a fraction of the costMaximize and optimize distribution

Access investors globally in multiple broker platforms immediately through a euroclearable security with ISIN, with no additional investor KYC/AMLReach more investors through LYNK Markets

Become part of our intelligent platform that provides accredited and institutional investors with product selection, networking and tradingHow it works

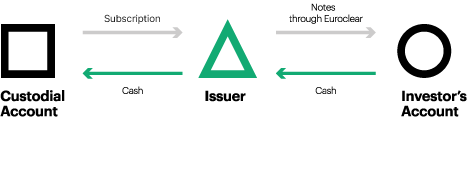

The Issuer opens a custody/trading account for the Portfolio Manager to implement his strategy and collects cash proceeds through the sale of Euroclearable securities with an ISIN in the form of notes.

LYNK-MARKETS FEEDER is a solution that enables the immediate purchase of selected regulated funds through a security. The securities are purchased in the form of euroclearable notes with an ISIN. These notes track the performance of the underlying asset or investment strategy. Our one-stop solution handles the issuance, maintenance, track record and real-time product information.

Worldwide access

Access funding worldwide immediately and safely, protected by regulated capital marketsNo unnecessary paperwork

No additional KYC is necessary. Eliminate time consuming paperwork or opening new accountsUnlock distribution

Distribute your investment strategy through an institutional level securityPublish in Bloomberg

Publish product, price and track record via BloombergHow it works

The Issuer enters into a subscription agreement with the regulated fund. It then funds its subscription through the sale of Euroclearable securities with an ISIN in the form of notes. Proceeds from the sale of the notes are invested into the underlying product with the cash being sent to its custody account.

Customer Testimonials

Pablo Cairoli

President, and CEO at Asset Managers

Buenos Aires, Argentina

LYNK Markets' solution has been a pivotal asset for us, streamlining our process to launch different investment strategies. This approach has enabled us to reach investors quickly and reliably, leading to significant and consistent results in record time.

Alistair Evans

Director, and Co-Founder at Sequence Capital

London, U.K.

Our experience issuing with LYNK Markets was exceptional. Their streamlined process allows to execute investments efficiently, reducing go-to-market lead times significantly.

Luiz Barros Filho

Head of Finance – Diretor Financeiro at MOMBAK

SAO PAULO, BRAZIL

Partnering with LYNK Markets has been transformative for MOMBAK. Their solution enabled us to engage with global investors smoothly and confidently. The process was straightforward, secure, and highly efficient, greatly enhancing our investment outreach and success.

Partnerships

team experience

CEO, CTO, CMO, GC

SEASONED EXECUTIVE TEAM

Product showcase

Fuel VC Note

1:1 exposure* to the underlying Fuel Venture Capital Flagship Fund I.

| Company | Asset Class | Offering Size |

|---|---|---|

| Fuel | Private Equity | $100M |

Fuel

Asset Class

Private Equity

Offering Size

$100M

Mombak

World’s largest carbon removal project: reforest the Amazon rainforest.

| Company | Asset Class | Offering Size |

|---|---|---|

| Mombak | Private Equity | $12M |

Company

Mombak

Asset Class

Private Equity

Offering Size

$12M

Confidas Capital SP1 U.S. Real Estate Credit Opportunity Note

Income producing, diversified portfolio of Bridge loans backed by U.S. Real Estate.

| Company | Asset Class | Offering Size |

|---|---|---|

| Confidas | Real Estate | $60M |

Company

Confidas

Asset Class

Real Estate

Offering Size

$60M

AMSA Strategic Developed Markets

Global opportunities centered on dev. market equities and corp. bonds.

| Company | Asset Class | Offering Size |

|---|---|---|

| AMSA | Hedge Fund | $55M |

Company

AMSA

Asset Class

Hedge Fund

Offering Size

$55M

Hamilton Lane Senior Credit Opportunities Securitize Fund

Fund with added liquidity potential through on-demand redemptions.

| Company | Asset Class |

|---|---|

| Hamilton Lane | Private Credit |

Company

Hamilton Lane

Asset Class

Private Credit

Coming soon

EFI-Algotrade 2

We implement an active management strategy of a 100% algorithmic absolute return fund.

| Company | Asset Class | Offering Size |

|---|---|---|

| Emerge Funds | Hedge Fund | $50M |

Company

Emerge Funds

Asset Class

Hedge Fund

Offering Size

$50M