Our automated issuance and maintenance processes provide Asset Managers with an unparalleled customer experience and speedy time to market, all at a fraction of the cost.

Your gateway to Portfolio Strategies and Alternatives where buyers and sellers converge to trade innovative portfolio strategies and exclusive alternative investments.

Our integrated lead generation engine designed to enhance Asset Managers’ reach and visibility to financial advisors within top broker/dealers, multi-family offices and private banks.

Create a bankable security to enhance access to your investment strategy to qualified investors.

LYNK MARKETS SMA solution securitizes investment strategies held in a custody/trading account through the issuance of Euroclearable securities with an ISIN. It provides a cost efficient solution for all size portfolios and allows distribution to non-retail investors worldwide. Our one stop solution handles the issuance, maintenance, track record and real-time product information, thereby allowing Portfolio Managers to create unique investment products from their individual strategies.

Create your own products with a turnkey solution

Develop investment strategies that the market demands with the constant support of recognized global financial and legal institutionsAllow efficiencies for cost and time-to-market

Take advantage of the LYNK´s platform that allows for the quickest time to market at a fraction of the costMaximize and optimize distribution

Access investors globally in multiple broker platforms immediately through a euroclearable security with ISIN, with no additional investor KYC/AMLReach more investors through LYNK Markets

Become part of our intelligent platform that provides accredited and institutional investors with product selection, networking and tradingHow it works

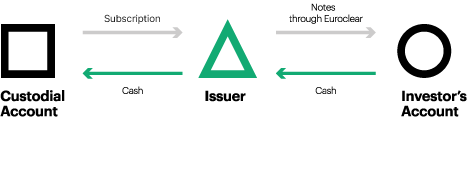

The Issuer opens a custody/trading account for the Portfolio Manager to implement his strategy and collects cash proceeds through the sale of Euroclearable securities with an ISIN in the form of notes.

LYNK-MARKETS FEEDER is a solution that enables the immediate purchase of selected regulated funds through a security. The securities are purchased in the form of euroclearable notes with an ISIN. These notes track the performance of the underlying asset or investment strategy. Our one-stop solution handles the issuance, maintenance, track record and real-time product information.

Worldwide access

Access funding worldwide immediately and safely, protected by regulated capital marketsNo unnecessary paperwork

No additional KYC is necessary. Eliminate time consuming paperwork or opening new accountsUnlock distribution

Distribute your investment strategy through an institutional level securityPublish in Bloomberg

Publish product, price and track record via BloombergHow it works

The Issuer enters into a subscription agreement with the regulated fund. It then funds its subscription through the sale of Euroclearable securities with an ISIN in the form of notes. Proceeds from the sale of the notes are invested into the underlying product with the cash being sent to its custody account.

Achieve greater visibility and increase engagement among top financial advisors within Broker/Dealers, Family Offices and Private Banks

- Get ahead of the curve. Manage your product centrally to track insights analytics for better strategic decision making.

- Deliver an unparalleled advisor experience by providing relevant strategy’s performance data and other key information.

- Unlock your strategy’s potential with Reach 360º our Lead Generation Engine for enhanced product visibility and qualified lead generation.

- Measure advisors’ interest in real time.

- Offer and manage rebates and incentives. Keep your strategy top of mind for advisors.

- The most efficient and preferred approach. Keep your strategy top of mind for advisors.

Expanding Assets Managers’ reach by creating connections with Advisors Seeking Investment Opportunities

Reach360º, Lynk Markets integrated lead generation engine was designed to elevate Asset Managers’ influence in the competitive financial landscape. At the heart of Reach360º is a commitment to expanding your reach and enhancing your visibility, not just as a service but as a strategic partner in your growth.

In an industry where connections mean everything, Reach360º bridges the gap between Asset Managers and Advisors seeking promising investment opportunities.

We offer a robust marketing engine that combines the best of both online and offline tools to forge meaningful connections between sellers (asset managers) and buyers (financial advisors). Our innovative mix-and-match service model puts you in control, allowing you to select from a suite of tools to tailor a marketing strategy that aligns with your goals and budget.

Featured Listings

Insights and Analytics

Targeted Campaigns

<span data-metadata=""><span data-buffer="">Event

Co-Sponsorships

Content Strategy